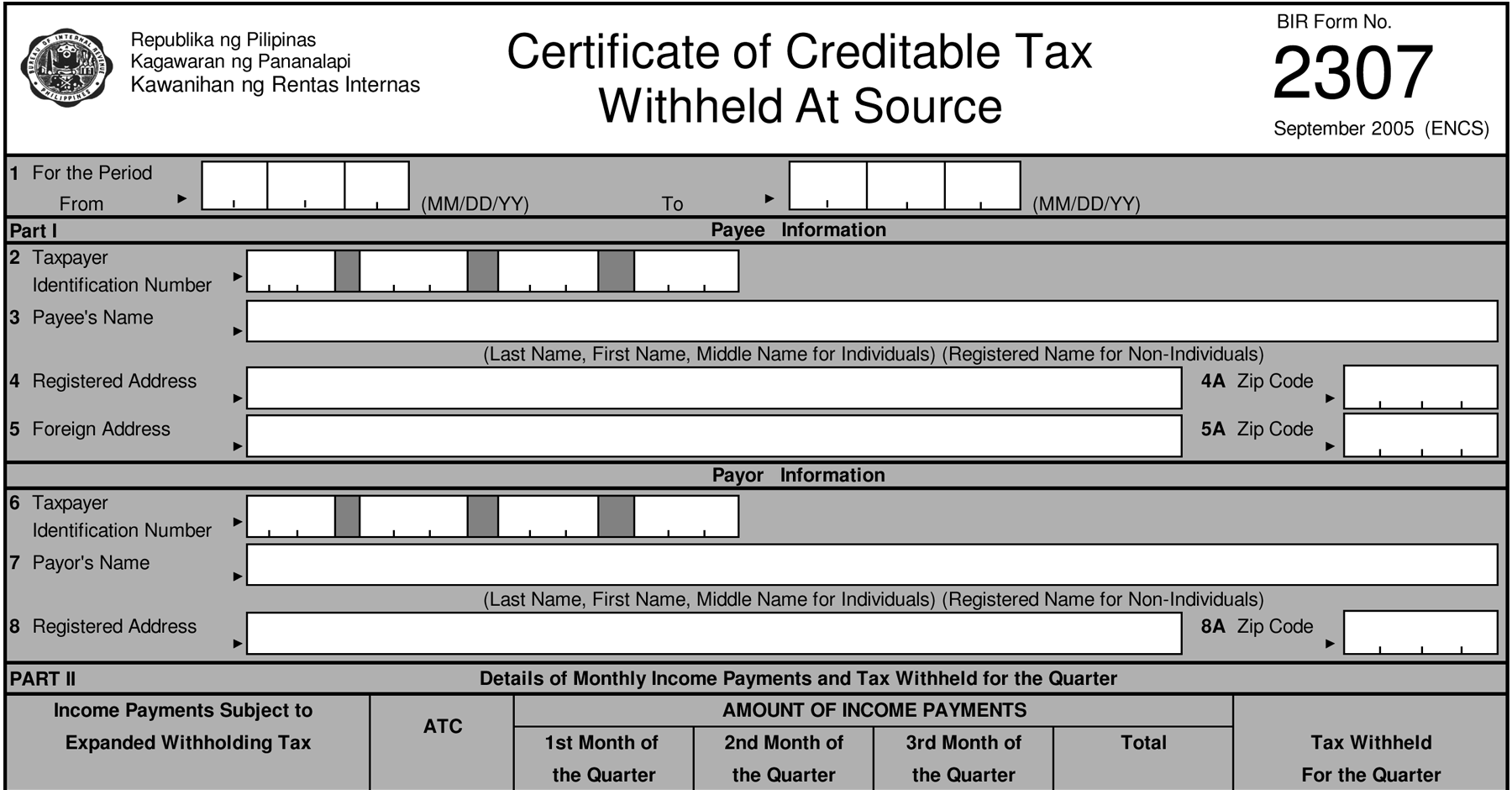

How to Generate BIR Form 2307 | Form 2306

This tutorial assumes that the user has prior knowledge of preparing

BIR Form 2307. If you have not prepared it before, bir-excel-uploader.com is

not for you yet. Nothing beats knowing the real thing, please head on to

bir.gov.ph and learn it first.

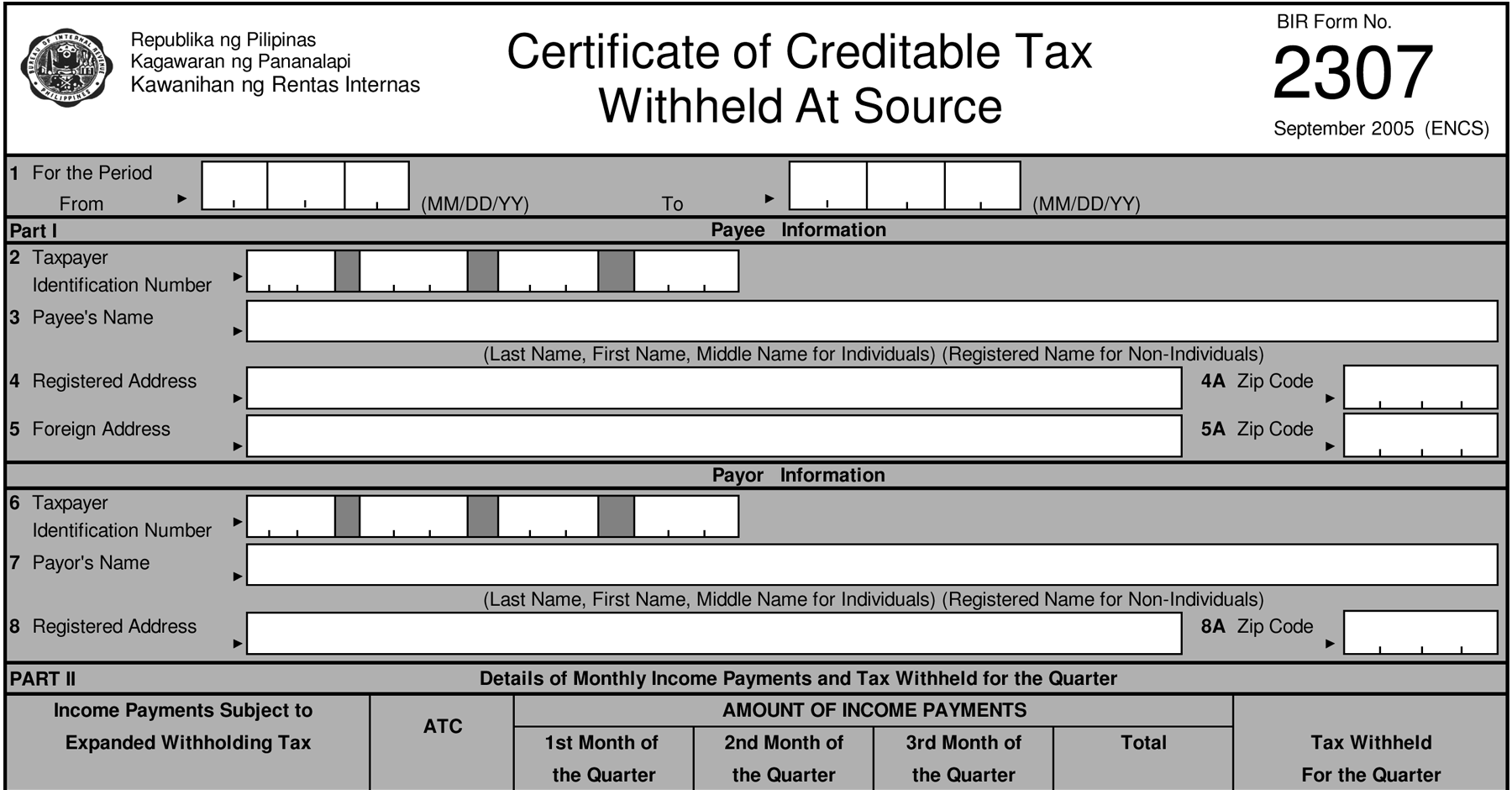

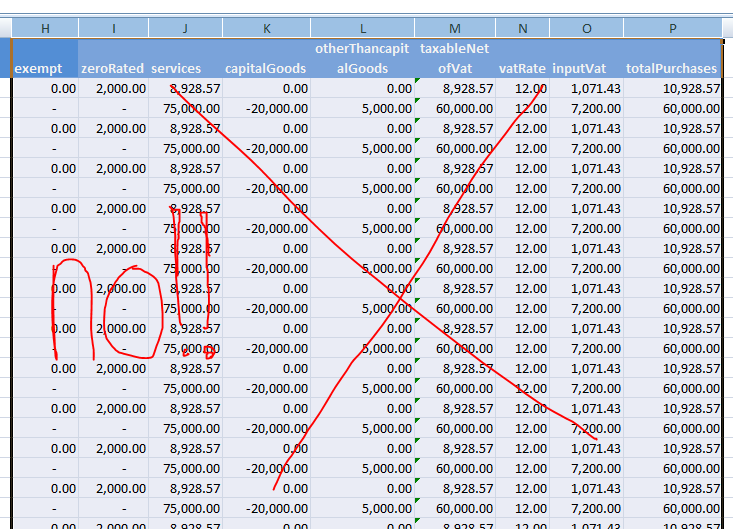

Prepare the Excel Template

- Click the excel icon to choose the excel template to be used.

- Click

BIR Form 2307 to download the template. Open the template and

take time to analyze the sample data. Row1 is fixed, DO NOT edit or

fomat Row1. In case you accidentally edit it, please download a new

copy of the template.

a. Reporting_Month - month when the tax

was withheld, do not leave it blank

b. Vendor_TIN - 9 digit

TIN, example 123-456-789-000, the first 9 digit is the TIN, do not

leave it blank

c. branchCode - the last digit 3 is the branch

code, do not leave it blank

d. address - Vendor address, optional

e. nature - Nature of Income Payment is optional. Leave it blank to

use default BIR description.

f. ATC - required

g.

income_payment - number, required

h. ewt_rate - ATC and ewt_rate

should much

i. tax_amount - income_payment multiply by ewt_rate

- Again, DO NOT edit Row1 and DO NOT work directly in the

template. Common mistake on working directly in the template is

selecting the whole column then clicking the comma ( , )

number format. In effect, Row1 was edited, resulting the whole

column to errors. To resolve this error, download a new template.

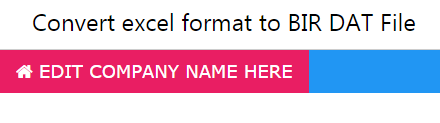

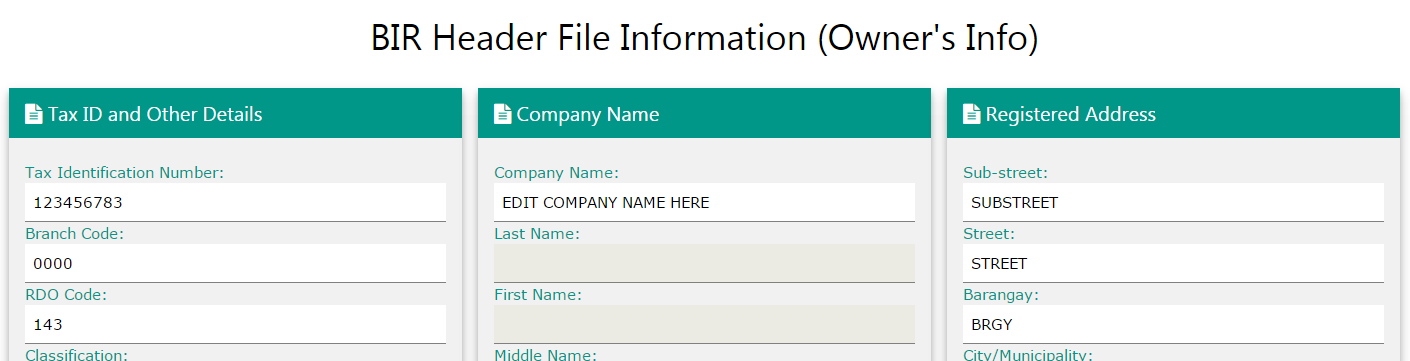

Set BIR Header File (Owner's Info)

- Click "EDIT COMPANY NAME HERE" to set BIR Header Information. This is important because all DAT File will include this information

- All fields are required, DO NOT put dummy data, this will be

part of your DAT File.

- Click Save BIR Header File. You can save as many TINs as you

want, all data and details will auto switch based on the TIN that

you will use.

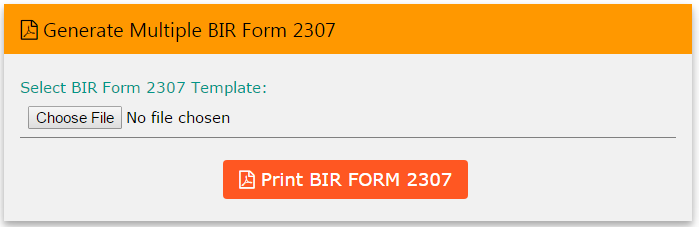

Generate BIR Form 2307

- Once done on the template preparation and BIR Header Information,

its time to convert your excel file template to BIR Form 2307.

Accepts "xls" file only.

- If error occured, please read it carefully then revise your

file if necessary.